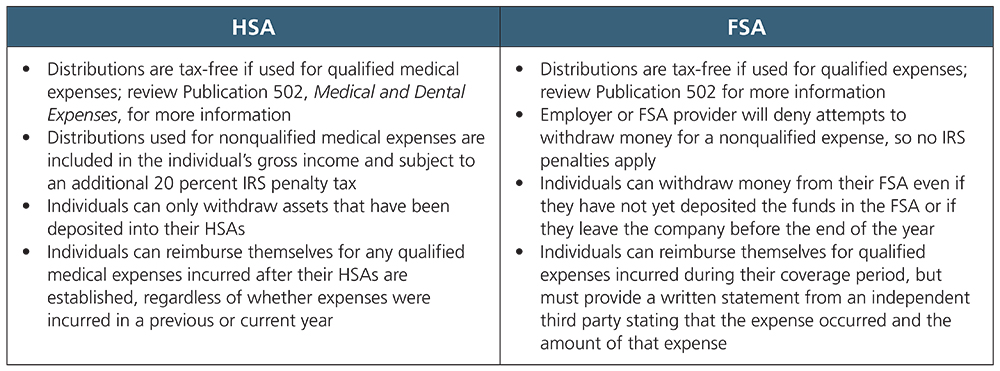

fsa health care vs hsa

There are notable differences between an HSA vs. Your employer may also choose to.

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

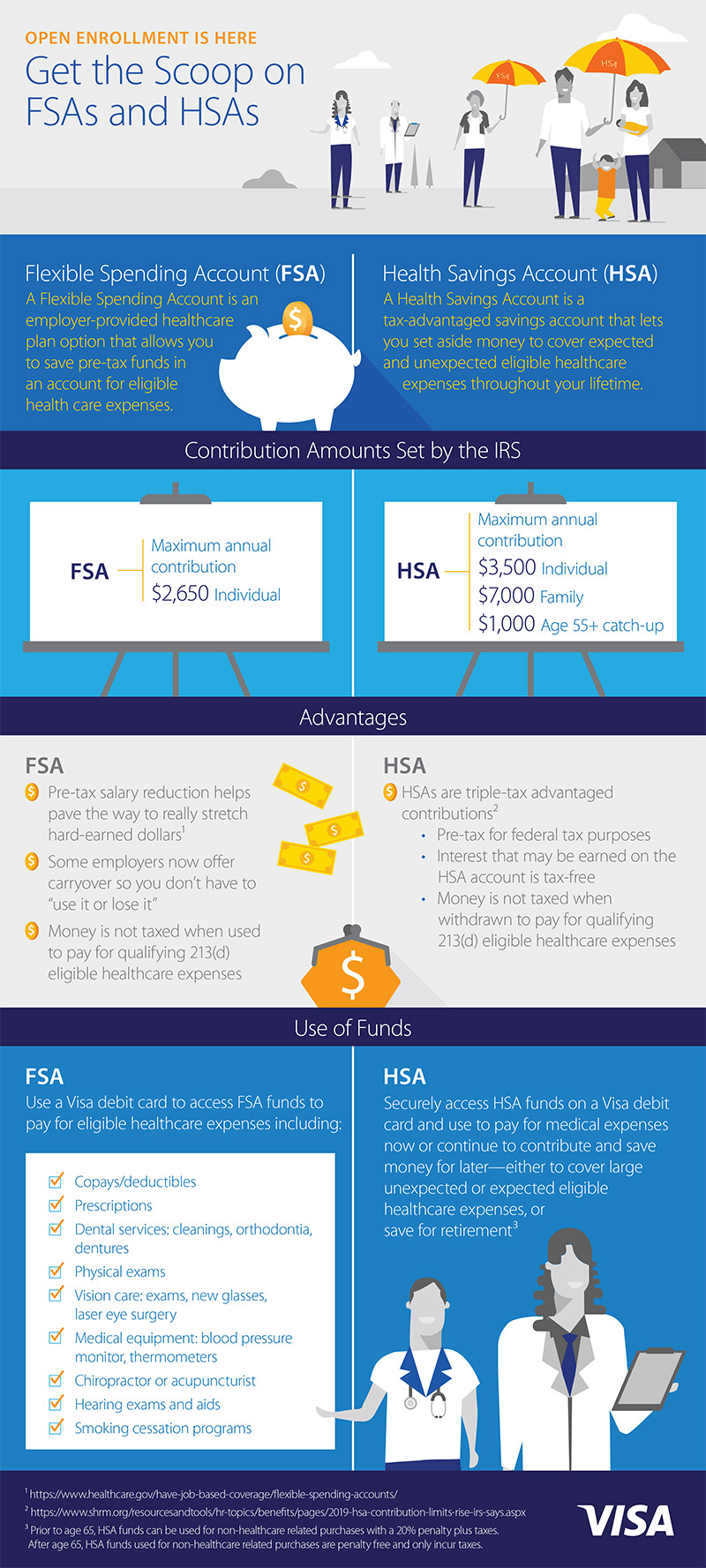

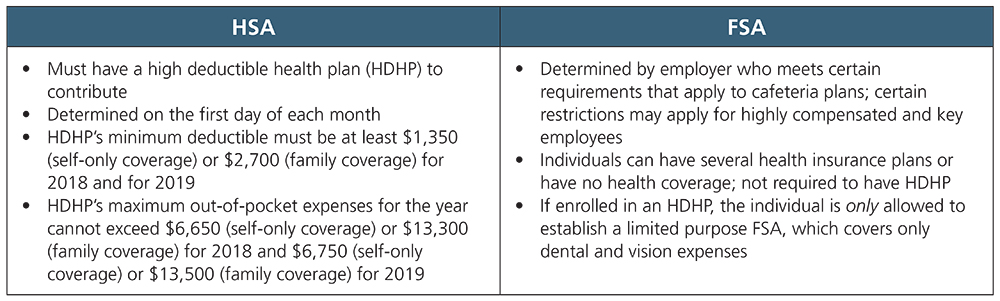

Healthcare FSAs are a type of spending account offered by employers.

. If you newly enroll in an FSA or HSA for 2023 you will receive a welcome package from WEX that includes a debit card and important information. Both FSA and HSA accounts offer tax-advantaged ways to save money and cover your health-related expenses. Tax-free interest or other earnings on the money in the account.

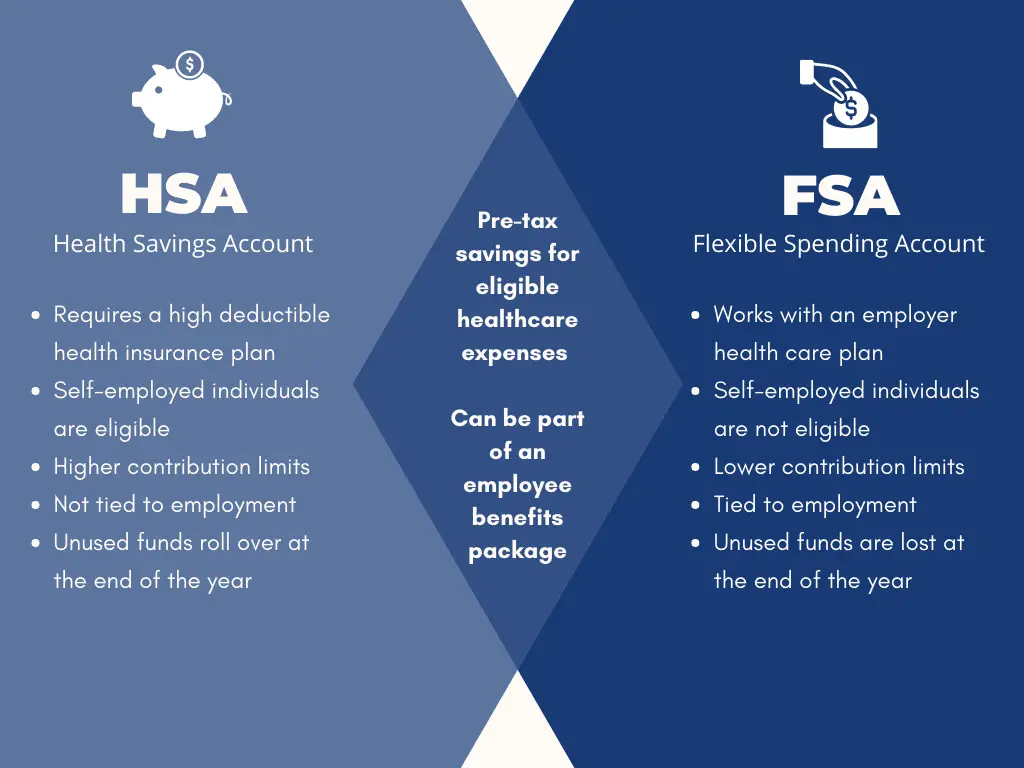

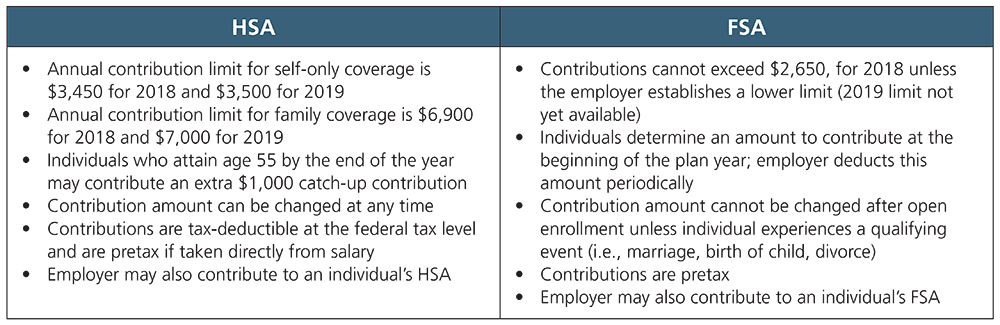

You can open an HSA or. The key differences between the two accounts are who qualifies. Health savings accounts HSA and flexible spending accounts FSAs both provide tax savings on qualified medical costs.

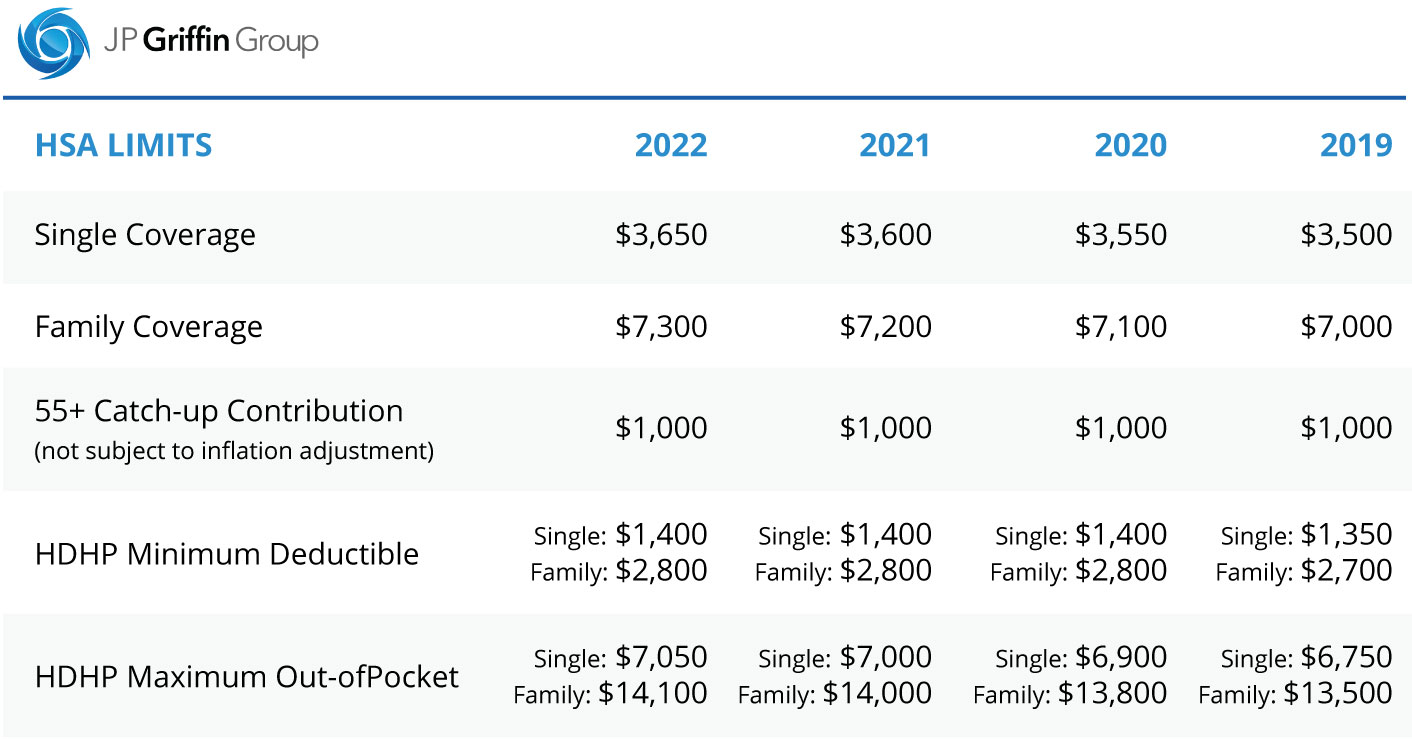

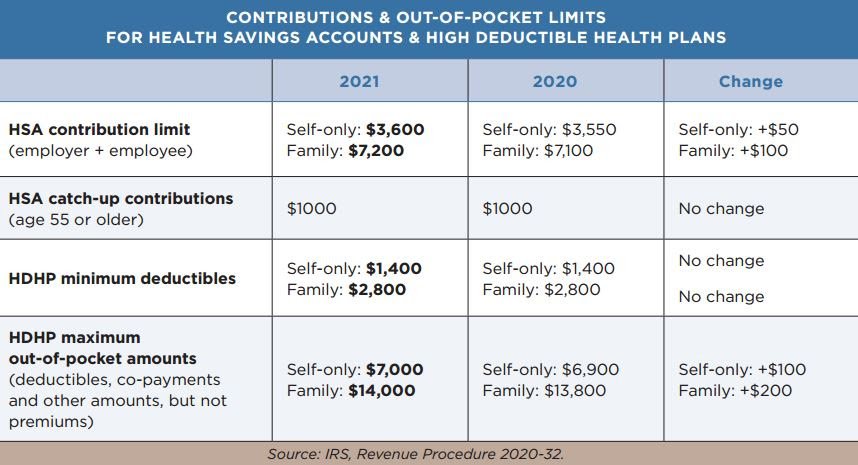

The 2022 max for HSA contributions is 3650 for individual coverage and 7300 for family coverage. An HSA and FSA are both tax-advantaged accounts that let you stash your own money away for future health care costs. An HSA account unlike FSA requires you to have a high deductible health.

HSAs are referred to as providing triple tax savings. Up their HSA by earning tax-free interest as well as tax-free returns from investing their funds. An HRA is tax-free for both you and your employer.

An HSA and FSA are both tax-advantaged accounts that let you stash your own money away for future health care costs. However there are a few key differences that. IRS max contribution for an FSA in 2022 is 2850.

An FSA is a better fit if. You Can Easily Use Your Funds During the Contribution Year. Nov 08 2021 The HSA contribution range refers to 3600 for an individual and 7200 for a family account.

You can open an HSA or. HSA vs FSA. In terms of eligibility you are only eligible for an HSA under an HDHP or high deductible health plan.

Pre-tax dollars are put aside from your paycheck into your FSA. As flexible as HSAs seem health FSAs are a better option for some people. An HRA is an employer-owned and -employer-funded account designed to help members bridge the gap on eligible healthcare.

FSAs are generally paired with traditional health plans. You dont pay federal state or Social Security. HSA vs FSA.

But be aware that the. In the 1970s the IRS created the Flexible Spending Account FSA to allow employees to pay pre-tax dollars for medical expenses and dependent care expenses that are.

What Is The Difference Between A Medical Fsa And An Hsa Healthinsurance Org

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Hsa Vs Fsa See How You Ll Save With Each Wex Inc

Health Spending Accounts What S The Difference Between An Hsa And Fsa Thinkhealth

Comparing Tax Favored Hsa Hra Fsa Medical Options Don T Mess With Taxes

Hsa Vs Fsa The Ultimate Guide For Federal Employees

Hsa Vs Fsa What You Need To Know To Save Money On Healthcare

Why Do Consumers Leave So Much Fsa And Hsa Money On The Table Visa

Hsa Vs Fsa What S The Difference How To Choose Bankrate

Hsa Vs Fsa Diagnosing The Differences Ascensus

Should You Add An Hsa Or An Fsa To Your Health Benefits For 2020

High Deductible Health Plans Health Savings Accounts And Future Of Healthcare Review By Kbni Houston Katy Woodlands Spring Pearland Conroe Kingwood Humble Sealy Baytown Beaumont Tomball Port Arthur Spine Back And

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services

Carefirst Bluecross Blueshield By Choosing An Hsa Hra Or Fsa You Re Making An Important Decision Affecting How You Pay And Save For Healthcare Expenses We Want To Help You Understand The

Hsa Vs Fsa Diagnosing The Differences Ascensus

Hsa Vs Fsa Diagnosing The Differences Ascensus

Hsa And Fsa University Of Colorado